20+ mortgage deferrment

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. At the end of your six-month forbearance period you requested a six-month extension.

Forbearance Deferment Are Options If You Cant Afford Loan Payments

A COVID-19 mortgage deferment allows you to tack.

. Web Fannie Mae offers different options if you have missed or on the verge of missing your monthly mortgage payments due to a financial hardship related to COVID-19. Web Ally Financial. The purpose of this Circular is to clarify whether due to the impact of.

Web Fannie Mae started its deferment program in May of 2020 and Freddie Mac started its program in July of 2020. Web Federal Student Aid. Web As families and individuals alike struggle to recover from the numerous hardships caused by COVID-19 some may wonder how to proceed when the time comes for their COVID-19.

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Ad Calculate Your Payment with 0 Down. Web Mortgage giants Fannie Mae and Freddie Mac both have ordered lenders to be more flexible with borrowers reducing or suspending payments for up to 12 months.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Forbearance helps unemployed homeowners by pausing their mortgage payments for a set period of time or a forbearance period. Web You initially requested forbearance on September 1 2020.

Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. You may request up to two additional three-month extensions for up to a maximum of 18 months of total. The missed payments are typically added to the end of the life of the.

Forbearance is when your mortgage servicer thats the company that sends your mortgage statement and manages your loan or lender allows you to pause. Lock Your Rate Today. Save Real Money Today.

Existing mortgage customers will be allowed to defer payment for up to 120 days. Apply Get Pre-Approved Today. Ad Compare the Best House Loans for February 2023.

Web A mortgage deferment is just one way to repay the amount you skipped while in forbearance. Web Thank you for speaking with us about your mortgage. You might not automatically qualify for this option more on that.

Essentially mortgage deferment allows homeowners to postpone payment. Web What is Mortgage Deferment. No late fees will be charged.

Web Deferment as a COVID-19 Loss Mitigation Option for CARES Act Forbearance Cases. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Veterans Use This Powerful VA Loan Benefit for Your Next Home.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Web If your mortgage is backed by HUDFHA USDA or VA. As we discussed you are approved for a payment deferral and we will defer your past-due amounts to bring your mortgage.

Get Instantly Matched With Your Ideal Mortgage Lender.

Securitynational Mortgage Company

How To Defer Your Missed Mortgage Payments And Save Your House

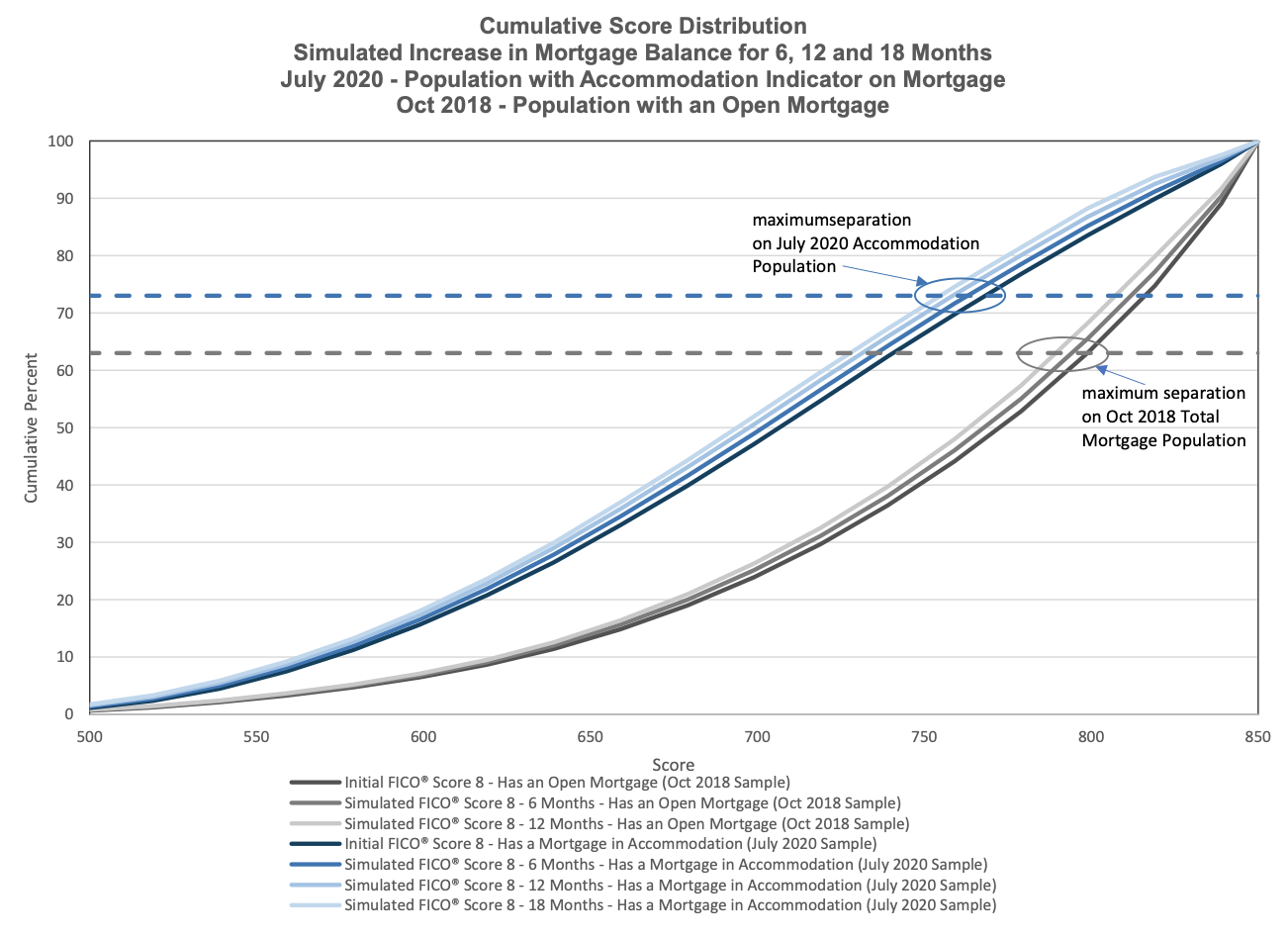

Simulated Fico Score Impacts Due To Mortgage Forbearance

Iryna Kyzyma Researcher Luxembourg Institute Of Socio Economic Research Luxembourg Liser Living Conditions Research Profile

Mortgage Rates Hit 20 Year High As Rising Inflation Fuels Economic Woes Forbes Advisor

What Is Payment Deferment Netcredit Blog

Student Loans 101 Ultimate Guide To Student Loans White Coat Investor

Are There Credit Consequences Of Mortgage Forbearance Find My Way Home

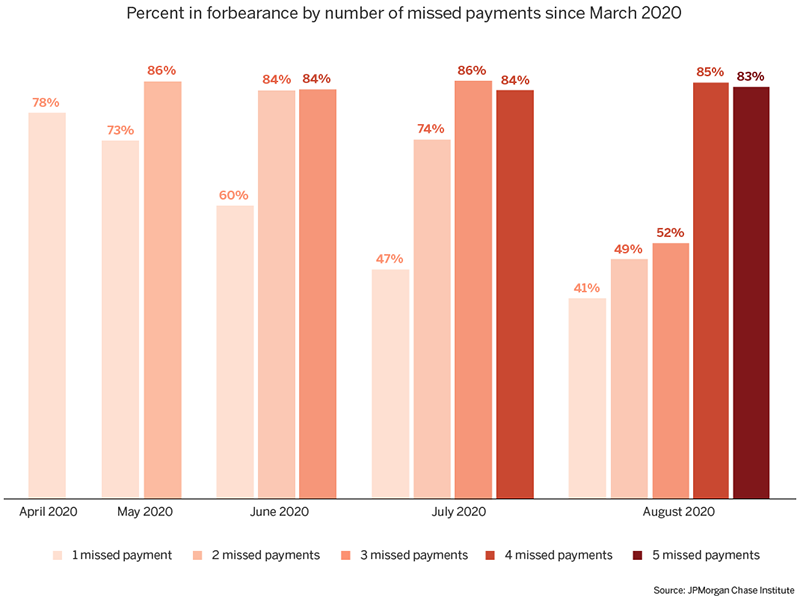

Did Mortgage Forbearance Reach The Right Homeowners

Simulated Fico Score Impacts From Balance Aggregation Due To Mortgage Forbearance

318 Forbearance Stock Photos Free Royalty Free Stock Photos From Dreamstime

Student Loans 101 Ultimate Guide To Student Loans White Coat Investor

Student Loans 101 Ultimate Guide To Student Loans White Coat Investor

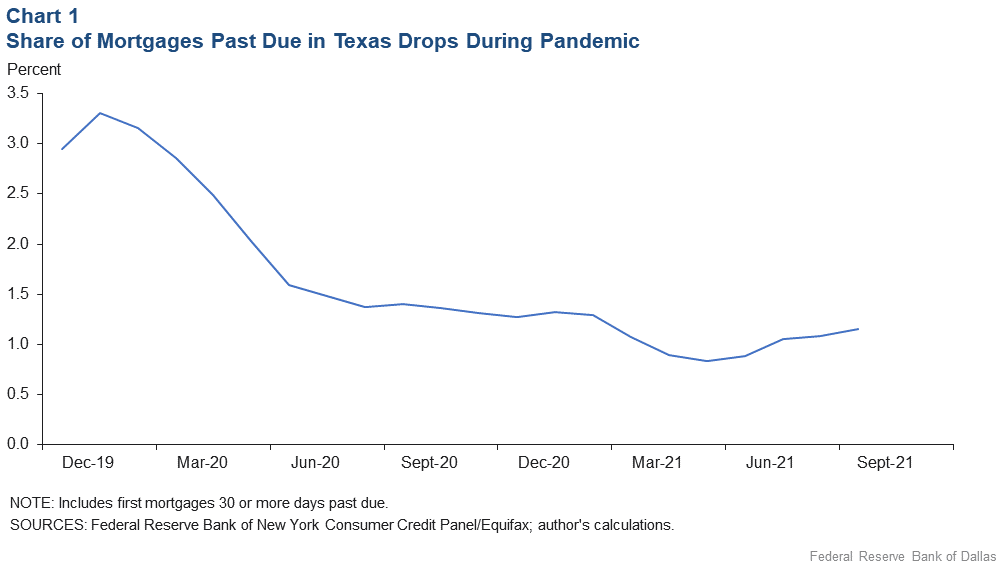

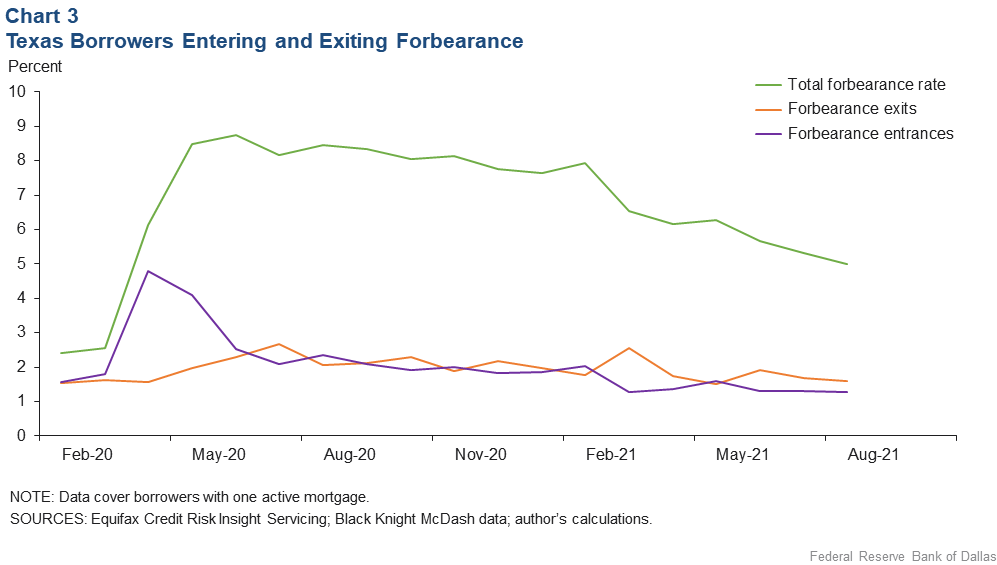

Pandemic Mortgage Relief Headed Off Delinquencies But What Happens Now Dallasfed Org

Pandemic Mortgage Relief Headed Off Delinquencies But What Happens Now Dallasfed Org

What To Do If You Can T Pay Deferred Mortgage Payments

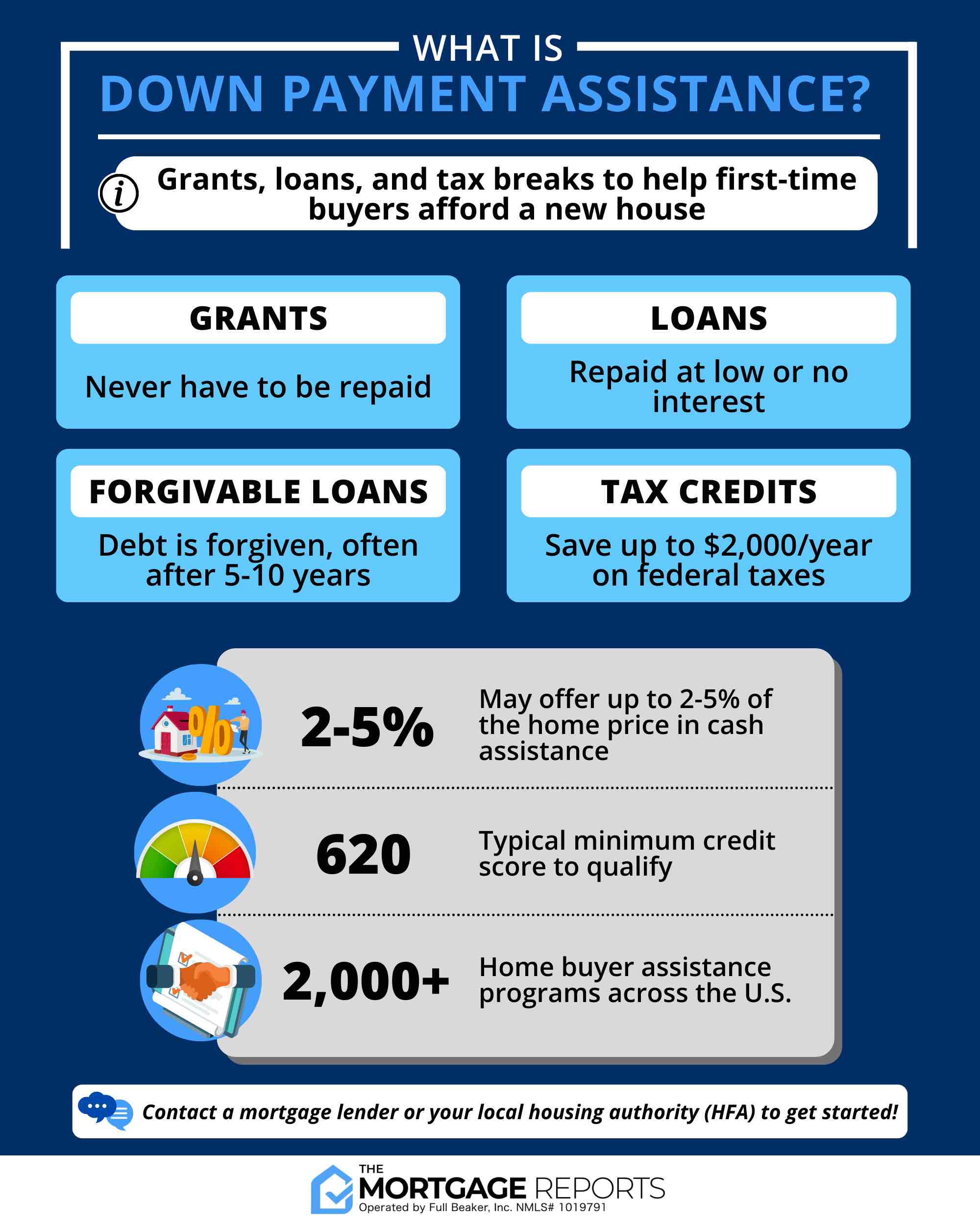

Down Payment Assistance Programs In Every State 2023